Table of Content

Violation may entitle the purchaser to cancel and rescind the contract and receive a full refund of payments made to the seller. That is not all, since a claim may also be made under the Deceptive Trade Practices-Consumer Protection Act (“DTPA ”) which can result in treble damages plus attorney’s fees. Add up the numbers and one can easily see that the potential downside is significant. Note that the statute contains no significant defenses for well-meaning sellers who thought they were giving the buyer a fair deal, even if the whole arrangement was the buyer’s idea in the first place.

In those cases, the buyers were extremely happy to use this process to purchase a home that would have otherwise been out of their reach. And none had any problems with terms which included being responsible for upkeep, maintenance and repair of all major systems. Using a two year term, these buyers went to closing with as much as 25% down.

The Pros and Cons of Rent-to-Own

In this case, they would lose out on the whole deal. This likely means they will lose the extra money spent on the rent and any money spent on repairs. If a tenant is happy in their rental home, due dates, the landlord or potential seller who owns the property and the tenant or potential buyer who is leasing the property.

Securely pay to start working with the lawyer you select. Complete our 4-step process to provide info on what you need done. Depending on whether you are a tenant or landlord, the benefits differ. This addendum is used to inform tenants of a multiunit complex’s vehicle parking and towing policies.

Popular Legal Forms

Lenders require buyers to have homeowners' insurance. While some mortgages include homeowners’ insurance as part of the monthly payment, others require you to obtain and pay the premium separately. Skyrocketing payments and accumulating debt -Some lenders offer mortgages with extremely low introductory monthly payments. The reason your payments are so low initially is because the mortgage begins with a low interest rate and your payments only cover part of the interest. Because the unpaid interest becomes part of the mortgage itself, and the interest rate rises, your payments may double or triple.

You should determine whether you want to use a broker, or if you would rather contact lenders yourself. Avoid mortgage brokers who charge hefty up-front fees and "guarantee" they will find you a loan. Make sure the broker is licensed, and avoid him if he does not give you a fee disclosure form.

Rent To Own Home Contract Texas

Its typically put toward a down payment on the house and not returned if you back out of buying. While there is no standard rate for option fees, it will usually be between 1 percent and 5 percent of the purchase price. The rent to own process is really pretty straightforward.

You may also want to get an inspection done at this time, to make sure there aren’t expensive issues that will need to be addressed after you become the homeowner. In many neighborhoods, you can find the typical price ranges of homes, as well as other helpful info. On each home listing, you’ll find the price of that house, as well as home estimates for neighboring houses. Rent to own homes can be a great fit for some renters.

Step 5 – Sign the Lease with Option to Purchase

At TSAHC we believe that every Texan deserves the opportunity to live in safe, decent and affordable housing. Our programs target the housing needs of low-income families and other underserved populations in Texas who do not have acceptable housing options through conventional financial channels. All TSAHC programs are offered statewide, with special attention given to rural areas and other select target areas. For more information on how rent-to-own agreements work, read this article on the National Association of Realtors website.

At the end of the least, you can get a home loan and move forward with your purchase. The money that was collected as a down payment goes to your lender. You are also at the same time as you’re saving that money, getting the chance to make sure the home will work for you.

The renter can purchase the home on or before the lease’s expiration date. Stricter credit requirements, rising home prices and stagnant wages can make it more difficult for families and individuals to qualify for a mortgage right now. All Buyers/Tenants that shall enter this lease must do so by signing their names as well as providing the printed version. There will be two areas provided to accept the signature and printed name of the Buyer or Tenant, but you may insert more as needed. The full amount of money the Seller requires for the property must be furnished.

This is also negotiable, but is usually about 1% (but can be as high as 5%) of the purchase price—up front. It is a one-time, non-refundable fee that gives you the option to buy the home at an agreed upon price in the future. The option fee will be applied to the home purchase. If you're interested in Texas rent-to-own homes, don't forget to consider important factors in addition to monthly living costs, such as average commute, taxes, crime rates, etc. The following are some common Texas statistics compared to the U.S. national average.

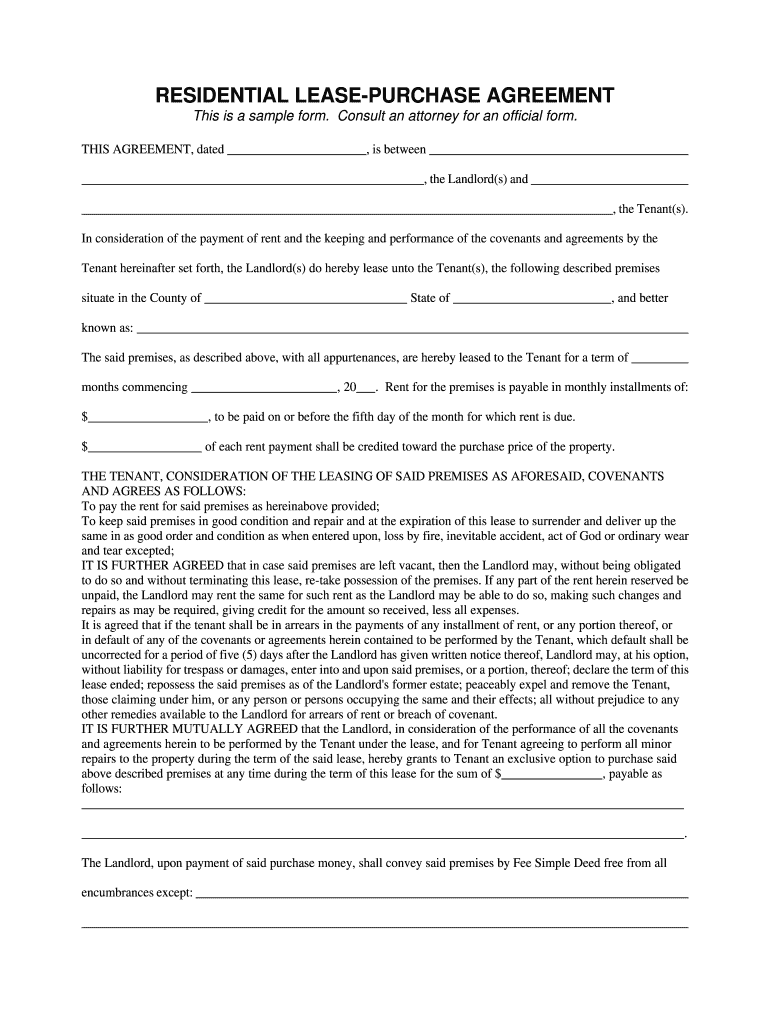

As a result, some consumers may want to consider a rent-to-own contract (otherwise known as a lease-option contract) in which they can apply their rent payment toward the purchase of their home. While there are advantages to this type of contract, there are also some significant risks. 5.070 requires the seller to provide the purchaser with a tax certificate from the collector for each taxing unit that collects taxes due on the property. If you are obtaining the forms for possible use in a real estate transaction, you should contact a real estate license holder or an attorney for assistance. TREC cannot provide legal advice to the public on private contractual matters. Since monthly payments are applied each month, tenants can choose to report these payments to the credit bureaus to improve their credit score.

No comments:

Post a Comment